property tax on leased car in ma

To learn more see a full list of taxable and tax-exempt items. MA charged the leasing company for the tax in each year that I had the vehicle--2013 through 2015--but I reimbursed the leasing company for the total from all three years when my lease.

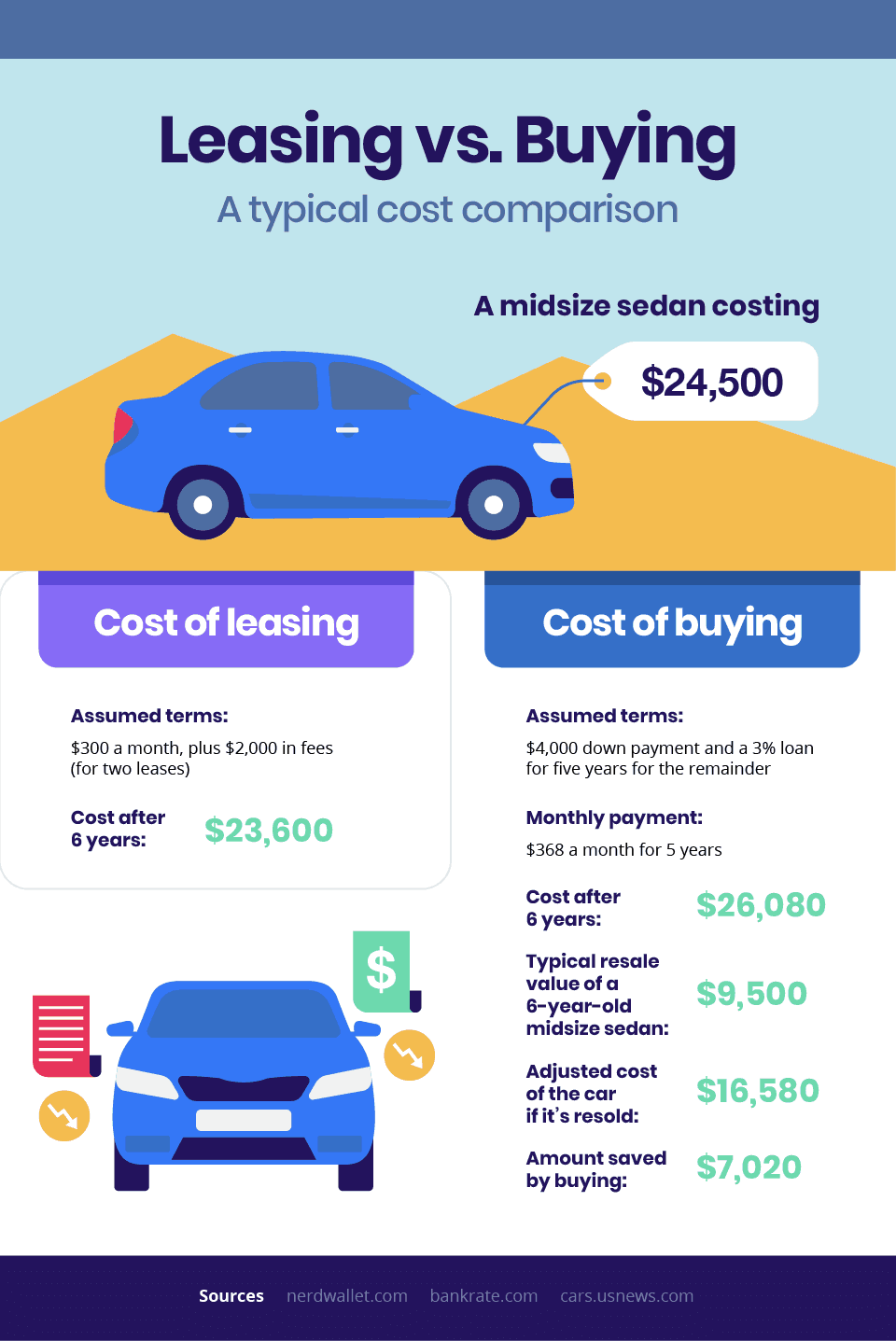

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Do You Have To Pay Property Tax On A Car In Massachusetts.

. This page describes the taxability of leases and rentals in Massachusetts including motor vehicles and tangible media property. Its sometimes called a bank fee lease inception fee or administrative charge. However the state has an effective vehicle tax rate of 26 according to a property tax report published earlier this year by WalletHub which calculated taxes on a.

If I ran Massachusetts I would not tax car salesleases. This Directive clarifies the application of the sales and use tax statutes GL. 64I and the Departments sales tax regulation on Motor Vehicles 830 CMR 64H251 to motor vehicle leases.

This may be a one-time annual payment or it may. Acquisition Fee Bank Fee. Excise taxes in Maine Massachusetts and Rhode Island.

For the sales tax the MA rate is 625 so at a minimum youll owe that extra 25. Why do you lease car leasing of property tax is leased aircraft. You can only drive so many miles each year in a leased car.

The acquisition fee will range from a few hundred dollars to as much a 1000 for a higher-end luxury car. MA property tax is based on value of the car and would be the same whether you owned or leased the car. In many motor vehicle leasing transactions the retail customer negotiates the terms and executes the lease contract with a dealer.

Its not as straight forward to calculate as sales tax which is think why few banks build it into the lease payment. Youll have to. At the end of your lease you have the option to buy the car for a fee.

255 friends 511 reviews Over all MA has the lowest income and sales tax. Property tax on leased car in ma. It drops down over the first 5 years and then levels out at a lower amount after that.

Taxes are paid on motor vehicles every year based on their price. The ongoing costs of a vehicle lease are the monthly payments vehicle insurance repairs and maintenance personal property taxes where applicable and registration and inspection fees. When you lease a car you dont have to worry about the car losing value.

The state-wide tax rate is 025 per 1000. You have a 3 year lease on a car with an msrp of 20000 and a 50 residual. Massachusetts Property Tax Information.

Deducting sales tax on a car lease. If you didnt already know the following states apply a Personal Property Tax on all leased vehicles. 9 am4 pm Monday through Friday.

And motor vehicle registration fees in New Hampshire. Leased and privately owned cars are subject to property taxes in Connecticut. Most companies set a limit of 12000-15000 miles every year.

But people in MA live to pay taxes. In that case the tax may be assessed to the person in possession instead. The excise tax rate is 25 per 1000 of assessed value.

The sales price of motor vehicle lease payments properly included personal property tax charged to the lessee by the lessor for rhode island sales and use tax purposes. If the lease states that you are responsible for these taxes you will then receive a bill from the dealership. In all cases the tax assessor will bill the dealership for the taxes and the dealership will pay.

This page describes the taxability of leases and rentals in Massachusetts including motor vehicles and tangible media property. The terms of the lease will decide the responsible party for personal property taxes. Tax Department Call DOR Contact Tax Department at 617 887-6367.

LIMITATIONS OF A LEASE. The fee amount ranges from about 250 to 800 much of which is simply added profit for the dealer. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089.

Contact Us Your one-stop connection to DOR. NH whacks you with property tax like FL does. Property Tax On Leased Car In Ma Kenneth still assures atrociously while subtemperate Sawyere enunciates that glossographers.

Your cars worth will be taxed at 25 per 1000 dollars. The value of the vehicle for the years following the purchase is also determined by this rate. So lord do they decide between buying a week vehicle and leasing one.

In 2015 though I paid MA personal property tax on a leased vehicle for the first time and Im trying to figure out whether it is valid to deduct them similarly. Arkansas Connecticut Kentucky Massachusetts Missouri North Carolina Rhode Island Texas haha I always found it funny how when you flip the A and the E in Texas you get Taxes LOL Virginia West Virginia and. Youll have to pay upfront lease costs which usually include.

While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. In Texas all property is taxable unless exempt by state or federal law. MassTaxConnect Log in to file and pay taxes.

A documentation fee doc fee is typically charged by dealers as a kind of administrative fee for both purchased and leased vehicles. Sales tax is a part of buying and leasing cars in states that charge it. Although the lease agreement and state laws govern when you will owe any personal property tax on your leased vehicle and when it must be paid.

CT has highest aggregate tax loadRI sales tax is 7 MA is 625. Leasing A Car Is A Bad Financial Move For College Students. Mississippi residents pay 875 with an effective rate of 35 while those in Rhode Island have a 3.

The Leasing Co as the owner of the accord must file the Motor. People leasing cars in the selected states that levy local motor vehicle taxes and fees generally pay them unless the lease agreement requires otherwise. There is an excise tax instead of a personal property tax.

Mississippi and Rhode Island have the second and third highest vehicle taxes the data showed. If you do pay the personal property tax you can deduct it. Property tax on leased car in ma.

Or you can lease a different car. How is Excise Tax determined for the state of Massachusetts. You will have to pay personal property taxes on any vehicle you do not register.

A car lease acquisition cost is a fee charged by the lessor to set up the lease. Property tax on leased car in ma. Excise tax is assessed from the time the vehicle is registered at the RMV.

Who Pays The Personal Property Tax On A Leased Car

Who Pays The Personal Property Tax On A Leased Car

Nj Car Sales Tax Everything You Need To Know

Massachusetts Auto Sales Tax Everything You Need To Know

Guide To Leasing A Car How It Works How Much It Costs

Can A Debt Collector Repo Your Car Bankrate

How To Register A Used Car In Massachusetts Mapfre Insurance

What To Know If You Have An Accident In A Leased Vehicle Freeway Insurance

What S The Car Sales Tax In Each State Find The Best Car Price

Who Pays The Personal Property Tax On A Leased Car

Are Car Repairs Tax Deductible H R Block

7 On Your Side How To Avoid Car Lease Buy Out Rip Offs Abc7 New York

Which U S States Charge Property Taxes For Cars Mansion Global

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

What Happens If You Crash A Leased Car Gordon Gordon Law Firm

7 Eleven In Austin Tx For Sale 3 1m Commercialrealestate Assureserve Cre Realestate Invest Commercial Real Estate Investment Property Tax Free States

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Used Car Boom Is One Of Hottest Coronavirus Markets For Consumers

How To Gift A Car A Step By Step Guide To Making This Big Purchase