capital gains tax changes 2021

On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. The intended capital gains tax will.

New Tax Initiatives Could Be Unveiled Commerce Trust Company

In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

. Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. If you are filing your taxes as a single person your capital gains tax rates in 2021 are as follows. Rishi Sunaks government is reportedly on the hunt for around 21 billion 24 billion of new taxes as part of a budget that will need to find more than 50 billion in revenue.

Add state taxes and you may be well over 50. Rumours are circulating that Hunt is looking at tinkering with Capital Gains Tax including the possibility of changing the reliefs and allowances on the tax or increasing the tax. The rates do not stop there.

The individual tax rate could just from 37 to 396 for those making more than 400000 annually. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help. However it was struck down in March 2022.

On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. As per the report the panel proposed a long-term capital gains LTCG tax of 10 per cent on profits from the sale of equity assets that are held for more than a year. I was stunned as anyone when I read about the new Biden administrations proposed changes to the capital gains tax and stepped-up basis.

This tax change is targeted to fund a 18 trillion American Families Plan. Bring into line Capital Gains Tax with Income Tax. Additionally a section 1250.

If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. If CGT and Income Tax rates become more closely aligned the government could also consider. This tax change is targeted to fund a 18 trillion American Families Plan.

Long-term capital gains tax in the case of equities is 10 if the total gain in a financial year exceeds Rs 1 lakh. Currently long-term capital gains are in general taxed at 20. In the case of equity if the gain is more than Rs 1 lakh a 10 per cent tax is levied.

Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. If your income was between 0 and 40000. As proposed the rate hike is already in effect for sales after April 28 2021.

The 238 rate may go to 434 an 82 increase. As you can see the end result shows that the increase in the capital gains inclusion rate to 75 increases the overall taxes by 1338. Under the current rules long-term capital gains are taxed at 20 per cent.

In todays Budget Chancellor Rishi Sunak confirmed that dividend tax would rise by 125 percentage points from 6 April 2022 to tackle the current social care crisis. This means youll pay 30 in Capital Gains. Capital Gains Tax Rate 2021.

In other words for every 100 of capital. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more. However a 15 per cent.

Basic rate taxpayers would also see bills increase from 18 to 20. A reduction in the annual level of Capital Gains Tax exemption could be. Once fully implemented this.

ONS recommendations on Capital Gains Tax are. Raising the top capital gains rate for households with more than 1 million.

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

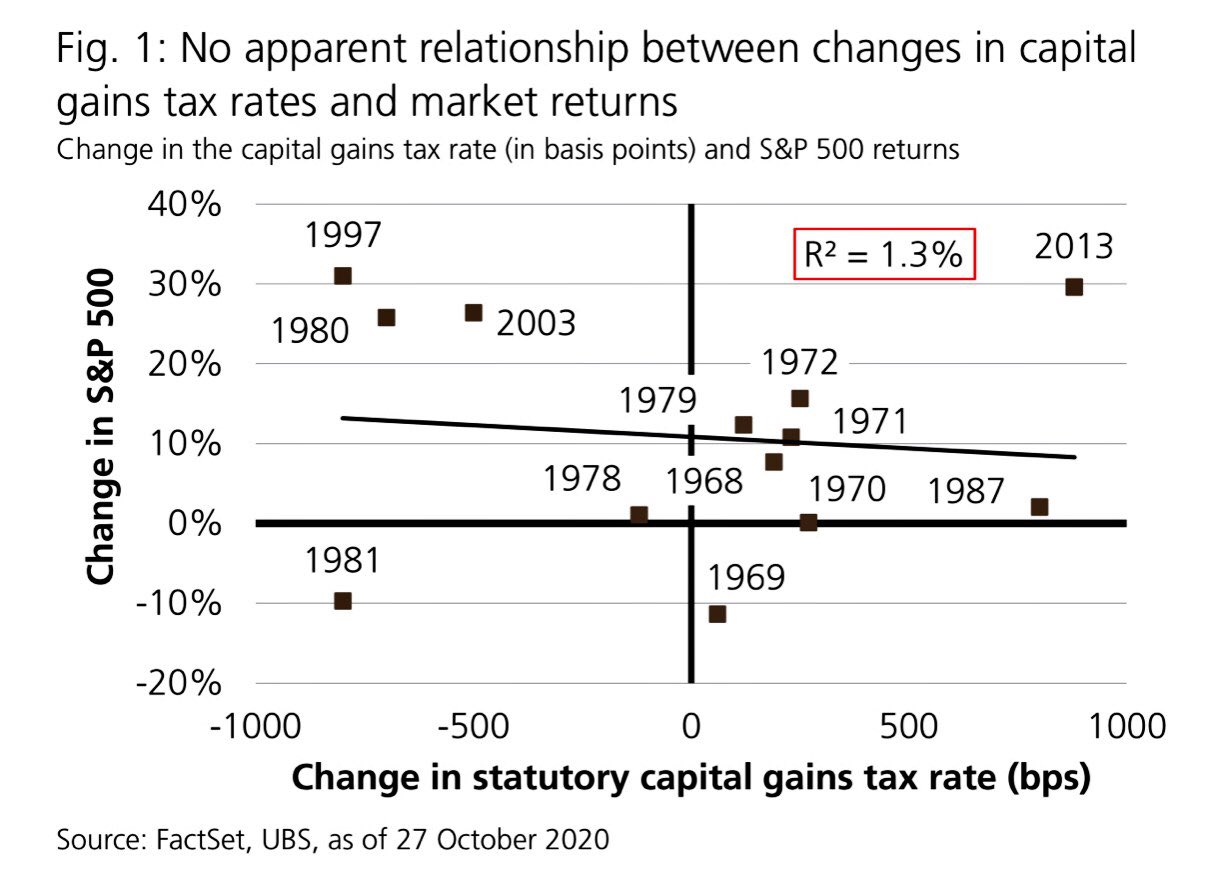

Carl Quintanilla On Twitter Correlation Between Capital Gains Tax And Market Returns 1968 2021 Via Johnspall247 Https T Co Gkocg8xlrw Twitter

One Benefit Of Biden S Capital Gains Tax Hike Fewer Mergers

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

President Biden S Capital Gains Tax Plan Forbes Advisor

Capital Gains Taxes And The Impact On The Sale Of Privately Held Companies

Capital Gains Tax Archives Skloff Financial Group

What You Need To Know About Capital Gains Tax

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

The Proposed Changes To Cgt And Inheritance Tax For 2022 2023 Bph

Liz Ann Sonders On Twitter Virtually No Relationship Between Changes In Capital Gains Tax Rate Amp S Amp P 500 Returns In Year Of Change Last Time Cap Gains Went Up In 2013

White House Considers Capital Gains Tax Cut Neutral Cost Recovery

How To Pay 0 Capital Gains Taxes With A Six Figure Income

How Are Capital Gains Taxed Tax Policy Center

How Are Capital Gains Taxed Tax Policy Center

Keeping The Farm 2021 Estate Gift And Capital Gains Tax Changes Youtube

2 Quick Points To Simplify Capital Gains Tax By Tunji Onigbanjo Datadriveninvestor